Tired of bitcoin price swings wiping out your gains? Discover how Binance’s stop-loss orders, OCO setups and position-size calculator can help you trade with confidence.

I still remember the first time I checked the bitcoin price and saw it swing more than 5 percent in a single hour. It felt like riding a roller-coaster blindfolded. Since then, I’ve made it my mission to tame those wild ups and downs by leaning on Binance’s built-in safeguards. In this article, I’ll walk you through the key tools: stop-loss orders, OCO setups and the position-size calculator that let me trade with confidence even when volatility spikes.

Understanding Bitcoin’s Volatility

I’ve come to expect wild swings from bitcoin: in fact, its annualized volatility topped 60 percent at points during 2023, while major stock indexes stayed near 20. In plain terms, a $1,000 stake could gain or lose about $600 over a year… And sometimes much faster. There’s an unmatched rush when bitcoin climbs 60 percent, but that high turns to dread when it drops just as sharply. Weathering these swings calls for more than a gut feeling; you need clear, pre-trade risk rules.

Stop-Loss Orders: Automatic Safety Nets

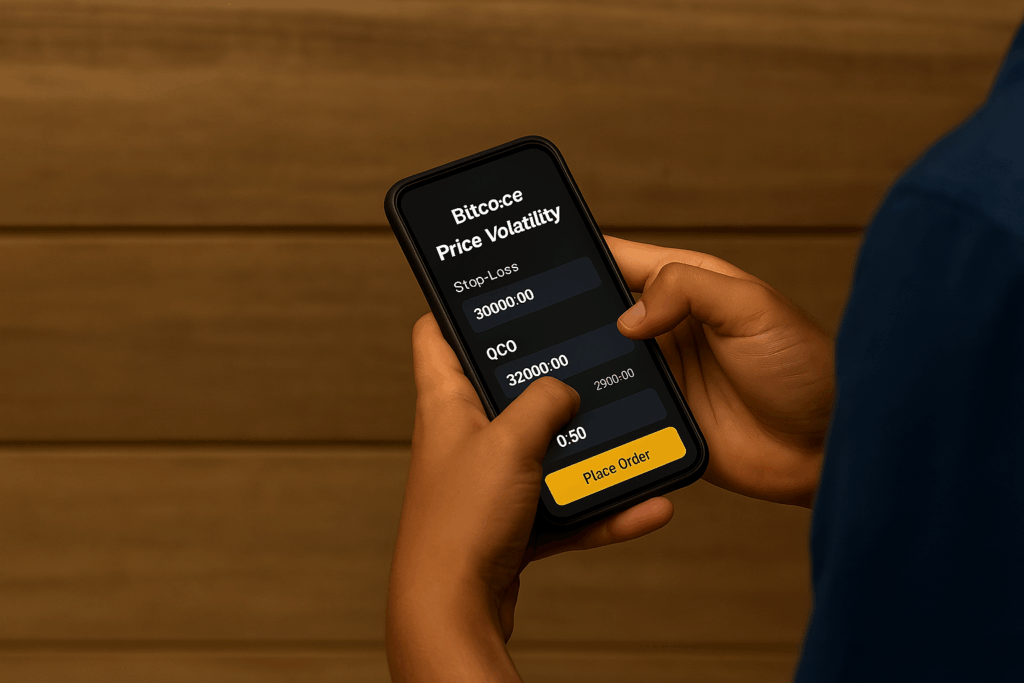

A stop-loss order is your first line of defense. I typically set mine to 2 percent below entry on scalps or 5 percent on swing trades. If the market ticks down to that level, my position closes automatically, capping my loss.

On Binance, I select “Stop-Limit” under the spot or futures tab, punch in my trigger price and limit price and I’m done. No more staring at charts, waiting for a manual exit. It’s like installing a safety rail on a cliff-side trail; you hope you never need it, but you’re grateful it’s there.

OCO Orders: One Cancels the Other

OCO (One-Cancels-the-Other) orders combine stop-loss and take-profit in a single package. I love this feature because it locks in profit targets while guarding against reversals. For example, if I buy BTC at $35,000, I might place an OCO with take-profit at $37,000 and stop-loss at $34,200. When either condition is met, the other leg is cancelled automatically. On Binance, you’ll find it under “Conditional” on the trading panel. It feels liberating to set both your profit ceiling and your loss floor in one shot.

Position-Size Calculator: Tailoring Your Trade

It took me a while to realise that managing volatility isn’t just about exits, it’s about how much you risk in the first place. Binance’s position-size calculator helps you translate a risk percentage into a precise order size. Say I only want to risk 1 percent of my capital on a given trade. I enter my account balance, my stop-loss level and I instantly get the exact quantity of BTC to buy. No more guessing or mental math under pressure. That discipline alone has saved me from outsized losses on whipsaw moves.

Combining Tools for Layered Protection

I rarely use just one tool. My go-to approach layers them: I calculate position size first, then deploy an OCO order that bundles my stop-loss and profit-target. If I’m trading futures, I might add a trailing stop to lock in gains when momentum builds.

This multi-pronged defence turns a frantic, reactive experience into a calm, methodical process. Today, I know exactly how much I stand to lose before I click “Buy” and exactly where I’ll take profit, no fearful surprises.

My Real-World Lessons

Last autumn, I opened a trade before a major policy announcement and forgot to set my stop-loss. Within minutes, Bitcoin slipped through three support levels and wiped out half my gains on that position. It stung. Since then, I’ve made it a hard rule: no trade without defined risk parameters. On another occasion, an OCO order cashed me out with a tidy 4 percent profit, just as the market tanked hours later. Those wins and losses taught me that mechanical risk rules beat intuition every time.

Best Practices for Staying in Control

- Define your maximum loss per trade (I cap mine at 2 percent of equity).

- Use the position-size calculator: it ensures your trades match your risk plan.

- Combine OCO orders with trailing stops when momentum is strong.

- Revisit your stop-loss levels as the market moves in your favour.

- Take regular breaks: emotion is a hidden source of volatility.

By treating risk-management tools as nonnegotiable parts of the trade rather than optional extras, you transform Bitcoin from a white-knuckle ride into a calculated venture.

Success is at Your Fingertips

Taming the wild swings of Bitcoin starts with a clear plan and the right tools. Binance’s stop-loss, OCO orders and position-size calculator aren’t gimmicks. They’re essential mechanisms for disciplined trading. I still feel that rush when volatility spikes, but now I face it armed with strategies that protect my capital and lock in gains. Try building your own risk-management framework on Binance and you might find that what once felt like chaos becomes a rhythm you can master.